News Releases

Metalline Announces NI 43-101 Resource Estimate Report on the Shallow Silver Zone

Vancouver, British Columbia - Metalline Mining Company (TSX: MMZ, AMEX: MMG) ("Metalline") is pleased to announce an updated NI 43-101 compliant resource report on the shallow silver zone at the Sierra Mojada Project in Coahuila, Mexico entitled "Shallow Silver Zone" Silver Zinc Deposit Sierra Mojada Project, Coahuila State, Mexico dated April 18, 2011 (the "Technical Report").

The mineral resource estimate for the Sierra Mojada Shallow Silver Zone deposit contained in the Technical Report has been independently modeled by Nilsson Mine Services Ltd and GeoSim Services Inc, as a potentially open-pittable deposit within a single optimized open pit shell at an economic cutoff grade of 20 gpt of silver with the following mineral resource classification:

- An Indicated silver resource of 9.235 million tonnes at an average grade of 56.4 gpt - equivalent to 16.75 million troy ounces of silver.

- An Inferred silver resource of 15.258 million tonnes at an average grade of 49.9 gpt - equivalent to 24.48 million troy ounces of silver.

A table of the silver resource at various cut off grades is shown below.

|

Class |

Cutoff Grade -- Ag gpt |

Tonnes 000's |

Average Grade - Ag gpt |

Silver Ounces |

|

Indicated |

10 |

10,717 |

50.8 |

17,506 |

|

15 |

10,080 |

53.2 |

17,243 |

|

|

20 |

9,235 |

56.4 |

16,748 |

|

|

25 |

8,311 |

60.2 |

16,088 |

|

|

30 |

7,242 |

65 |

15,136 |

|

|

Inferred |

10 |

16,397 |

47.6 |

25,096 |

|

15 |

16,118 |

48.2 |

24,980 |

|

|

20 |

15,258 |

49.9 |

24,481 |

|

|

25 |

14,050 |

52.2 |

23,582 |

|

|

30 |

12,267 |

55.8 |

22,010 |

|

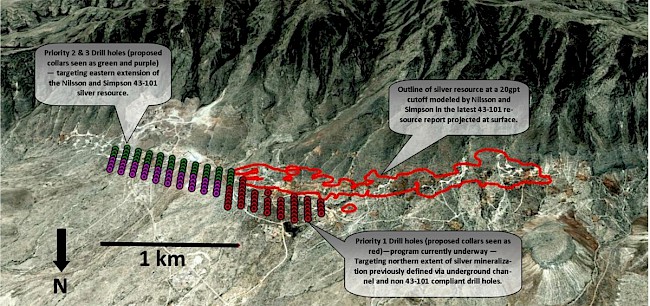

Tim Barry, President CEO and director of Metalline and qualified person (MAusIMM) states, "The latest NI 43-101 compliant Mineral Resource for Metalline focuses on the western end of the NI 43-101 inferred resource previously defined by Pincock Allan and Holt in January 2010. We are very excited by the fact that a significant portion of this latest resource is at or near surface and remains open along strike in both the east and west directions. A 20,000 meter drill program is currently underway, stepping out to the north and east to test silver mineralization previously highlighted by underground channel samples and drilling. We expect to begin publishing results from this drill program in early May".

The map below reproduced from the technical report shows the outline of the silver resource at a 20gpt cutoff as defined in the 43-101 report. The proposed drill holes for the 2011 drill campaign are also shown. Drilling is currently underway on the "priority 1" area which is targeting what is thought to be the northern extension of the silver resource.

The contents of this release have been reviewed and verified by John Nilsson, a professional geologist and Ron Simpson, professional geologist, who is a Qualified Persons pursuant to NI 43-101. To obtain a copy of the Technical Report please visit www.sedar.com.

About Metalline Mining Company

Metalline Mining Company is focused on the acquisition, exploration and development of mineral properties. Metalline currently owns mineral concessions in the municipality of Sierra Mojada, Coahuila, Mexico and holds licenses in Gabon, Africa. Metalline conducts its operations in Mexico through its wholly owned Mexican subsidiaries, Minera Metalin S.A. de C.V. and Contratistas de Sierra Mojada S.A. de C.V. To obtain more information on Metalline Mining Company visit the Company's web site www.metallinemining.com or www.sedar.com.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, MAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS CONTACT INFO:

Anthony Srdanovic, B.A. Comm

Manager Corporate Communications

Direct Line: (604) 895-7429

Office Line: (604) 687-5800

info@metallinemining.com

Cautionary note regarding forward looking statements. This news release contains forward-looking statements regarding future events and Metalline's future results that are subject to the safe harbours created under the Securities Act of 1933 (the "Securities Act") and the Securities Exchange Act of 1934 (the "Exchange Act") and constitute "forward looking information" within the meaning of Canadian securities laws. These statements are based on current expectations, estimates, forecasts, and projections about the industry in which Metalline operates and the beliefs and assumptions of Metalline's management. Words such as "expects," "anticipates," "targets," "goals," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "may," variations of such words, and similar expressions, are intended to identify such forward-looking statements. In addition, any statements that refer to the results of Metalline's drill program, projections of Metalline's future financial and operational performance, Metalline's anticipated growth and potential in its business and other characterizations of future events or circumstances are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, including such factors as the volatility and level of commodity prices, currency exchange rate fluctuations, uncertainties in cash flow, expected acquisition benefits, exploration mining and operating risks, competition, litigation, environmental matters, the potential impact of government regulations, and other matters discussed under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended October 31, 2010 and subsequent periodic reports, many of which are beyond our control. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements. Cautionary Note for US investors: The Company is an exploration stage company and does not currently have any known reserves and cannot be expected to have reserves unless and until a feasibility study is completed for the Sierra Mojada concessions that shows proven and probable reserves. There can be no assurance that the Company's concessions contain proven and probable reserves and investors may lose their entire investment in the Company.