News Releases

Silver Bull Intersects 214 g/t Silver, 1.5% Zinc, 0.92% Lead, and 0.7% Copper Over 38.6 Meters on its Sierra Mojada Property in Mexico

Vancouver, British Columbia -- Silver Bull Resources Inc. (previously "Metalline Mining Co.") (TSX: SVB, AMEX: SVBL) ("Silver Bull") is pleased to announce the results of assays for the first eight holes from its 2011 20,000 meter drill program at the Sierra Mojada Property in Mexico. The reported holes all lie immediately to the north of the eastern end of the "Shallow Silver Zone" (see the NI 43-101 compliant resource report on the "Shallow Silver Zone" authored by John Nilsson, a professional geologist and Ron Simpson, professional geologist, dated April 20, 2011, described in a press release issued by the Company on April 20, 2011 (the "Sierra Mojada Technical Report")). The reported drill results are shown in the table below and are highlighted by hole B11010 which averaged 214 g/t silver, 1.5% zinc, 0.92% lead, and 0.7% copper over 38.6 meters.

| SECTION 631500 | ||||||||

| Hole ID | From (m) | To (m) | Interval (m) | Ag g/t | Zn % | Pb % | Cu % | Comment |

| B11001 | 68.15 | 80 | 11.85 | 10.6 | - | - | - | |

| B11003 | 78 | 85 | 7 | 80.5 | 0.36 | 1.08 | 0.12 | Includes: 2m @ 153 g/t Ag & 3m @ 2.2% Zn |

| 102 | 111 | 9 | 35.3 | 0.1 | 0.1 | - | ||

| B11004 | 96.1 | 117 | 20.9 | 34.5 | 0.2 | 0.1 | - | Includes: 5m @ 68 g/t Ag |

| 122 | 132 | 10 | 43 | - | 0.1 | - | Includes: 4m @ 63 g/t Ag | |

| B11005 | 89.4 | 100 | 10.6 | 46.3 | 0.25 | 1 | 0.1 | Includes: 3m @ 145 g/t Ag, 4m @ 2.75% Pb & 4m @ 0.27% Cu |

| SECTION 631600 | ||||||||

| Hole ID | From (m) | To (m) | Interval (m) | Ag g/t | Zn % | Pb % | Cu % | Comment |

| B11008 | 87 | 88.25 | 1.25 | 59 | 3.79 | 1.06 | 0.2 | Includes: 4.2m @ 193.7 g/t Ag |

| B11009 | 104.9 | 119 | 14.1 | 40.2 | 0.43 | 0.12 | 0.12 | Includes: 6m @ 63 g/t Ag |

| B11010 | 110 | 148.6 | 38.6 | 214 | 1.5 | 0.92 | 0.7 | Includes: 16m @ 315 g/t Ag, 3.5m @ 6.45% Zn, 13m @ 1.63% Pb & 10m @ 1.25% Cu |

| B11011 | 120.9 | 131 | 10.1 | 12 | - | 0.12 | - | |

* Intervals shown are mineralized lengths of core. All intercepts crosscut shallow to moderately dipping bedding. The structural geometry and controls (if any) is not yet well understood to reliably calculate true widths.

Click to enlarge

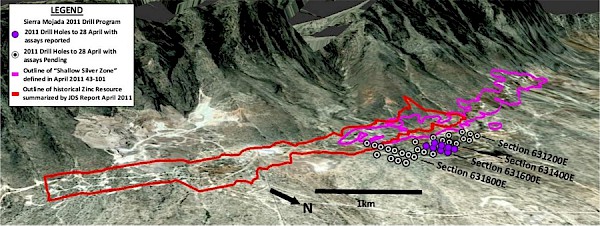

Image 1 (above): Gives the location of the drill collars in relation to the Shallow Silver Zone and the historical Zinc Resource. Source: Silver Bull Resources Inc.

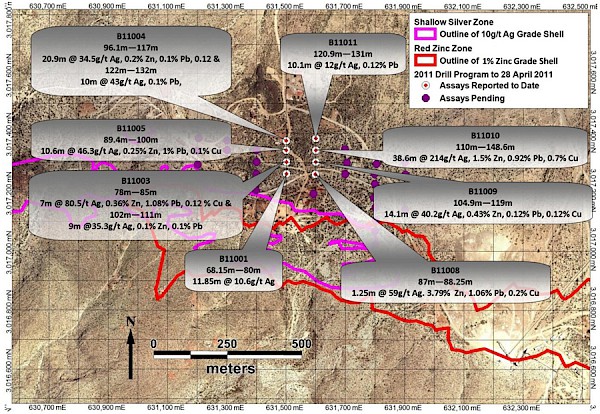

Image 2 (below): Shows the location of the drill collars in relation to the Shallow Silver Zone and Zinc Resource. Source: Silver Bull Resources Inc.

Click to enlarge

The results summarized above form part of the Silver Bull's "Phase 1" drill program which is designed to test a zone previously identified through historical underground channel samples that has never been tested with drilling. The holes described here are vertical, have been drilled on 100 meter lines and 40 meter centers and are between 100 to 200 meters in depth. Mineralization seen thus far is a mixture between the oxide mineralization seen in the "Shallow Silver Zone" which is hosted along contacts, fracture zones, and infill breccias of karst and cavern systems and deeper disseminated primary sulphide mineralization within the limestone country rock.

An additional 26 holes have been completed to date with assays pending.

About the Shallow Silver Zone

The "Shallow Silver Zone" is an oxide silver deposit (+/- zinc & lead), hosted along an east-west trending fracture-karst system set in a cretaceous limestone-dolomite sequence. The mineralized body averages between 30m -- 90m thick, up to 200m wide and has 9.235 Mt of "indicated" silver mineralization with an average grade of 56.4 g/t at a 20 g/t cutoff, and 15.258 Mt of "inferred" silver mineralization with an average grade of 49.9 g/t at a 20 g/t cutoff and remains open in the east, west and northerly directions (see the Sierra Mojada Technical Report available at www.sedar.com). Approximately 60 percent of the current two kilometer strike length is at or near surface before dipping at around 10 degrees to the east. At depth, the Shallow Silver Zone appears to merge with the "Red Zinc Zone", a historical "inferred" zinc resource recently summarized in a report by JDS Engineering and released onto the company's website on April 26, 2011.

Sample Analysis and QA/QC

All samples have been analyzed at ALS Chemex in North Vancouver, BC, Canada. Samples are first tested with the "ME-ICP41m" procedure which analyzes for 35 elements using a near total aqua regia digestion. Samples with silver values above 100ppm are re-analyzed using the Ag-GRA21 procedure which is a fire assay with a galvametric finish. Samples with zinc, lead, and copper values above 10,000 ppm (1%) are re-analyzed using the AA46 procedure which is a near total aqua regia digestion with an atomic absorption finish.

A rigorous procedure is in place regarding sample collection, chain of custody and data entry. Certified standards and blanks, as well as duplicate samples are routinely inserted into all sample shipments to ensure integrity of the assay process. The QA/QC of the assay results has been contracted to IOGlobal, an international and independent QA/QC and database management firm.

The technical information of this news release was prepared by or the preparation was supervised by Tim Barry, MAusIMM, a qualified person for the purposes of National Instrument 43-101 and the Chief Executive Officer of Silver Bull.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, MAusIMM

Chief Executive Officer, President and Director

Investor Relations | Anthony Srdanovic | Manager Corporate Communications

Direct Line: (604) 895-7429 | Office Line: (604) 687-5800

info@silverbullresources.com

Cautionary note regarding forward looking statements. This news release contains forward-looking statements regarding future events and Silver Bull's future results that are subject to the safe harbours created under the Securities Act of 1933 (the "Securities Act") and the Securities Exchange Act of 1934 (the "Exchange Act") and constitute "forward looking information" within the meaning of Canadian securities laws. These statements are based on current expectations, estimates, forecasts, and projections about the industry in which Silver Bull operates and the beliefs and assumptions of Silver Bull's management. Words such as "expects," "anticipates," "targets," "goals," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "may," variations of such words, and similar expressions, are intended to identify such forward-looking statements. In addition, any statements that refer to projections of Silver Bull's future financial performance, Silver Bull's anticipated growth and potential in its business and other characterizations of future events or circumstances are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, including such factors as the volatility and level of commodity prices, currency exchange rate fluctuations, uncertainties in cash flow, expected acquisition benefits, exploration mining and operating risks, competition, litigation, environmental matters, the potential impact of government regulations, and other matters discussed under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended October 31, 2010 and subsequent periodic reports, many of which are beyond our control. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements. Cautionary Note for US investors: Silver Bull is an exploration stage company and does not currently have any known reserves and cannot be expected to have reserves unless and until a feasibility study is completed for the Sierra Mojada concessions that shows proven and probable reserves. There can be no assurance that the Company's concessions contain proven and probable reserves and investors may lose their entire investment in the Company.