News Releases

Silver Bull Intersects 7.6 g/t Gold Over 9 Meters in Gabon

Vancouver, British Columbia -- Silver Bull Resources, Inc. (TSX: SVB, AMEX: SVBL) ("Silver Bull") is pleased to announce an intercept of 7.6 g/t gold over 9 meters on the Ndjole exploration licence held by Dome Ventures, a 100% owned subsidiary of Silver Bull, which is subject of a joint venture with AngloGold Ashanti ("AGA"). Details on the Gabon project and the exploration areas are available on the Silver Bull web site at http://www.silverbullresources.com/s/gabon.asp.

Highlights from the drill program include:

- Significant results:

- NDDD0017: 9m at 7.6 g/t Au; including 3.85m at 15.67 g/t Au

- NDDD0007: 13.5m at 1.5 g/t Au; including 1m at 7.5 g/t Au

- NDDD0015: 3m at 3.29 g/t Au; including 1m at 4.5 g/t Au

- NDDD0008: 15m at 37.7 g/t Ag; including 4.5m at 61.4 g/t Ag

(*All intercepts are mineralized lengths of core, true thickness has yet to be determined.)

- Gold mineralization appears to occur within massive sulphide or as gold bearing quartz veins associated with shear zones in the area.

- Numerous silver intersections within the system with three intercepts in excess of 60 g/t.

Click to enlarge

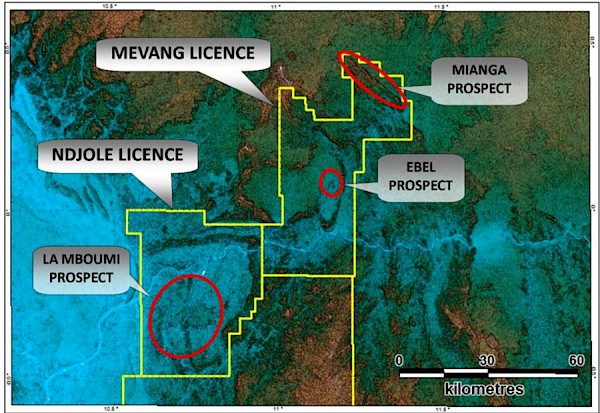

Figure 1. Ndjole and Mevang Licences with the main gold prospects identified in red by previous work. The current drill program focuses on the "La Mboumi Prospect" which is contained entirely within the Ndjole exploration licence.

A 5,300m drill program conducted under the direction of AGA is currently in progress on the "La Mboumi Prospect" of Silver Bull's Ndjole licence. This initial drilling program is a first pass follow-up on three gold soil anomalies which coincide with artisanal gold workings in the area. The bulk of the drilling to date has focused on the "La Mboumi Central" anomaly which is over 5km in length and sits in the hinge and along the eastern limb of a major fold in the area. All drilling is being completed using a man-portable diamond drill from E-Global Drilling with HQ sized holes. 3,500m of the planned 5,300m drill program has been completed to date.

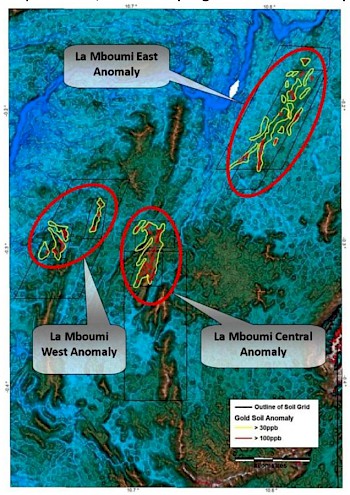

Figure 2. Outlined in red are the three main gold soil anomalies within the La Mboumi Prospect. Drilling has focused on the La Mboumi Central anomaly.

Results have confirmed that the gold mineralization has strong structural controls, concentrating along lithological contacts and structural breaks. There appears to be a strong spatial relationship of the gold mineralization to a carbonaceous black shale unit in the area which could represent an ideal lithological trap for mineralizing fluids.

Two styles of gold mineralization are seen in the core:

- A pyrite-rich massive sulphide sitting at the contact of a deformed mafic volcano-sedimentary sequence and a thick black shale unit. The massive sulphide hosts the 9m at 7.6 g/t Au intercept.

- Gold-arsenopyrite bearing quartz veins hosted on lithological contacts and within shear zones which are assaying between 2 g/t to 7 g/t Au.

Low grade intercepts of silver up to 85m in drilled length, occur within the weathered saprolite and are thought to be the result of supergene processes associated with ground water flow. The source of the silver mineralization in the system has yet to be identified.

A full summary of all drill results is tabulated in Table 1 below.

In addition to the drilling, AGA also recently completed a 3,660 line kilometer airborne electro-magnetic survey over the entire "La Mboumi Prospect" and an analysis and interpretation of this data is expected in the near future. Follow up drilling is now planned along strike to the north and south of hole NDDD0017 to test the extent of the massive sulphide mineralization as well as parts of the La Mboumi East gold anomaly.

| Table 1 | Gold Mineralization | Silver Mineralization | ||||||||

| HOLE NUMBER | From (m) |

To (m) | Interval (m)* | Au g/t | Interval Includes | From (m) | To (m) | Interval (m)* | Ag g/t | Interval Includes |

| NDDD0001** | 33 | 36 | 3 | 2.42 | ||||||

| NDDD0002** | No Significant Intercept | |||||||||

| NDDD0003** | 112 | 116 | 4 | 0.2 | ||||||

| NDDD0004** | No Significant Intercept | |||||||||

|

NDDD0005** |

98 | 101 | 3 | 0.7 | 1m @ 1.6 g/t Au | 0 | 10.5 | 10.5 | 6.5 | |

| 124 | 127 | 3 | 0.4 | 58.5 | 63 | 4.5 | 6 | |||

| 132 | 135 | 3 | 0.4 | |||||||

| NDDD0006 | 0 | 69 | 69 | 10 | 10.5m @ 66.5 g/t Ag | |||||

| NDDD0007 | 88 | 101.5 | 13.5 | 1.5 | 1m @ 7.5 g/t Au | 15 | 100 | 85 | 3.4 | 3m @ 24 g/t Ag and 2.4m @ 21.2 g/t Ag |

| NDDD0008 | 0 | 18 | 18 | 12 | 6m @ 27.4 g/t Ag | |||||

| 55.5 | 70.5 | 15 | 37 | 4.5m @ 61.4 g/t Ag | ||||||

| NDDD0009 | No Significant Intercept | |||||||||

|

NDDD0010 |

0 | 81 | 81 | 6.4 | 18m @ 18.7 g/t Ag | |||||

| 118.5 | 123 | 4.5 | 8.1 | |||||||

| 138 | 151.5 | 13.5 | 5.5 | |||||||

|

NDDD0011 |

142.5 |

147 |

4.5 |

0.5 |

55.5 | 82 | 26.5 | 2.5 | 3.5m @ 4.5 g/t Ag | |

| 92.2 | 94.5 | 2.3 | 11.5 | |||||||

| 140 | 153.5 | 13.5 | 11.9 | 1.5m @ 88.5 g/t Ag | ||||||

| NDDD0012 | 24 | 41 | 17 | 0.2 | 19.5 | 77.1 | 57.6 | 4.3 | 11.9m @ 6.9 g/t Ag | |

| NDDD0013 | No Significant Intercept | |||||||||

| NDDD0014 | 31.5 | 38.5 | 7 | 0.3 | 30 | 52.5 | 22.5 | 2.6 | ||

| NDDD0015 | 0 | 3 | 3 | 3.29 | 1m @ 4.5 g/t Au | |||||

| NDDD0016 | No Significant Intercept | |||||||||

| NDDD0017 | 134 | 143 | 9 | 7.6 | 3.85m @ 15.67 g/t Au | |||||

| NDDD0018 | Assay Pending | |||||||||

| NDDD0019 | Assay Pending | |||||||||

| NDDD0020 | Assay Pending | |||||||||

| NDDD0021 | Assay Pending | |||||||||

| NDDD0022 | Assay Pending | |||||||||

| NDDD0023 | Assay Pending | |||||||||

| NDDD0024 | Assay Pending | |||||||||

* Intervals shown are mineralized lengths of core, true thickness has yet to be determined. All intercepts crosscut sub vertical to vertical dipping beds and structure.

** Holes with recovery of less than 60%

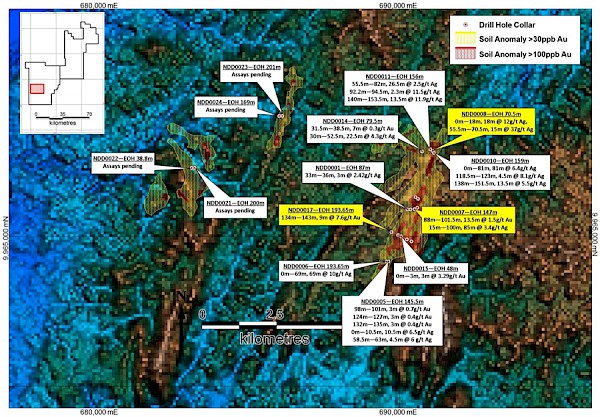

Figure 3. Drill holes with significant gold and silver intercepts beneath gold in soil anomalies. The background image is the digital terrain model of the area.

Sample Analysis and QA/QC

Assay determinations were carried out at ALS Chemex in Edenvale, Johannesburg where samples were crushed before a 250 gram split was pulverized to > 85% passing 75 microns. The pulverizing circuit was cleaned with quartz sand twice between samples. Splits of the pulverized fraction were routinely dissolved in aqua regia and analyzed for 48 elements by the ME-MS61 procedure using inductively coupled plasma (ICP) together with mass spectrometry (MS) or atomic emission spectroscopy (AES). Gold analyses were by the AuICP22 procedure that involves fire assay preparation using a 50 gram charge with an ICP-AES finish.

Rigorous procedures are in place regarding sample collection, chain of custody and data entry. Certified assay standards, duplicate samples and blanks are routinely inserted into the sample stream to ensure integrity of the assay process.

Geology of the Ndjole Licence

The 2000 km2 Ndjole exploration licence covers 90% of the Ndjole-Klossen block, a sedimentary basin comprising a sequence of sedimentary and volcano-sedimentary rocks that are early Proterozoic in age. The region is heavily forested and characterized by rugged topography (with gold artisanal workings in many of the streams. A deeply weathered horizon in excess of 100m in places covers a series of highly deformed rocks and is possibly prospective for massive sulphide and orogenic style mineralization. Much of the area remains underexplored.

About the AGA Joint Venture

Silver Bull entered into a joint venture agreement via its 100% owned subsidiary "Dome Ventures SARL Gabon" with AGA in October 2009 on its Ndjole and Mevang licenses. Under the terms of the joint venture agreement, AGA has earned a 20% interest by paying to Dome $400,000 on signing of the joint venture agreement. AGA can earn an additional 40% interest by paying Dome $100,000 per year over the next three years and by incurring exploration expenditures under the Ndjole and Mevang licenses in the amount of $3.7 million over three years at the rate of $1 million in the first year, $1.2 million in the second year and $1.5 million in the third year.

In addition to the Ndjole and Mevang licences currently under joint venture, Silver Bull also holds a third exploration licence in Gabon, the "Mitzic" Licence which is highly prospective for iron ore, as well as its flagship Sierra Mojada Project in Mexico.

Timothy Barry (MAusIMM), President and CEO for Silver Bull, is a Qualified Person as defined by National Instrument 43-101 and has reviewed and verified the technical information contained in this news release.

About Silver Bull

Silver Bull is focused on the acquisition, exploration and potential development of mineral properties. Silver Bull currently owns mineral concessions in the municipality of Sierra Mojada, Coahuila, Mexico and holds licenses in Gabon, Africa. To obtain more information on Silver Bull visit the web site at www.silverbullresources.com.

On behalf of the Board of Directors,

"Tim Barry"

Tim Barry, MAusIMM

Chief Executive Officer, President and Director

Investor Relations Contact Information:

Anthony Srdanovic, Manager Corporate Communications

Direct: (604) 895-7429 or Office: (604) 687-5800

info@silverbullresources.com

Cautionary note regarding forward looking statements. This news release contains forward-looking statements regarding future events and Silver Bull's future results that are subject to the safe harbours created under the Securities Act of 1933 (the "Securities Act") and the Securities Exchange Act of 1934 (the "Exchange Act"). These statements are based on current expectations, estimates, forecasts, and projections about the industry in which Silver Bull operates and the beliefs and assumptions of Silver Bull's management. Words such as "expects," "anticipates," "targets," "goals," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "may," variations of such words, and similar expressions, are intended to identify such forward-looking statements. In addition, any statements that refer to projections of Silver Bull's future financial performance, Silver Bull's anticipated growth and potential in its business and other characterizations of future events or circumstances are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, including such factors as the volatility and level of commodity prices, currency exchange rate fluctuations, uncertainties in cash flow, expected acquisition benefits, exploration mining and operating risks, competition, litigation, environmental matters, the potential impact of government regulations, and other matters discussed under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended October 31, 2010 and subsequent periodic reports, many of which are beyond our control. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements.