News Releases

Silver Bull Resources Announces 5.35 Billion Pounds Zinc, 87.4 Million Ounces Silver In Updated Sierra Mojada Measured And Indicated Resource

Including Separate And Distinct High-Grade Zones Of 13.5 Million Tonnes At 11.2% Zinc And

15.2 Million Tonnes At 114.9 g/t Silver

Vancouver, British Columbia -- Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”) is pleased to provide an updated NI43-101 Resource report for the Sierra Mojada Project in Coahuila, Mexico. Highlights of the resource update include;

- An open pittable, measured and indicated “High Grade Zinc Zone” of 13.5 million tonnes at an average grade of 11.2% Zinc at a 6% cutoff for 3.336 billion pounds of zinc.

- An open pittable, measured and indicated “High Grade Silver zone” of 15.2 million tonnes at an average grade of 114.9 g/t at a 50g/t cutoff for 56.3 million ounces of silver.

- Total Measured & Indicated Global Resource 70.4 million tonnes at 38.6 g/t Ag and 3.4% Zn that contain 5.354 billion pounds Zn and 87.4 million ounces Ag

- The updated resource was modelled using a silver price of US$15 per ounce, and a zinc price of US$1.20 per pound.

“This resource update models the mineralization defined at Sierra Mojada to zinc and silver prices realistic of the current market conditions”, stated Tim Barry, President, CEO and director of Silver Bull. “Sierra Mojada is one of only a handful of projects with any appreciable zinc resources and is one of the largest undeveloped silver-zinc projects in Mexico. It has excellent infrastructure; it is located 3 hours from an international airport with a paved road right to site; it has a functioning railway right to site; runs on grid power; and it has a skilled mining work force to draw upon in the immediate local area. This resource provides excellent leverage to both zinc and silver prices and has the potential to be scaled in size depending on metal prices.”

The Global Resource: The Global Resource is shown in table 1 with the “sub” tables defining the High Grade Silver Zone and High Grade Zinc Zone using a silver and zinc cutoff grade are shown in tables 2 and 3:

Table 1. Pit constrained Global Resource at a $13.50NSR cutoff

| CLASS | TONNES (MT) | AG (G/T) | CU (%) | PB (%) | ZN (%) | NSR ($/T) | AG (MOZS) |

CU (MLBS) |

PB (MLBS) |

ZN (MLBS) |

|---|---|---|---|---|---|---|---|---|---|---|

| MEASURED | 52.0 | 39.2 | 0.04% | 0.3% | 4.0% | $44.3 | 65.5 | 45.9 | 379.1 | 4,589.3 |

| INDICATED | 18.4 | 37.0 | 0.03% | 0.2% | 1. 9% | $27.3 | 21.9 | 10.8 | 87.0 | 764.6 |

| TOTAL M&I | 70.4 | 38.6 | 0.04% | 0.3% | 3.4% | $39.8 | 87.4 | 56.8 | 466.1 | 5,353.9 |

| INFERRED | 0.1 | 8.8 | 0.02% | 0.2% | 6.4% | $52.3 | 0.02 | 0.04 | 0.4 | 10.7 |

Notes

- CIM definitions were followed for the Mineral Resource.

- The Mineral Resource is reported within a conceptual pit-shell using an NSR cut-off value of US$13.50/tonne.

- Mineral resources are not reserves and do not demonstrate economic viability.

- Tonnages are reported to the nearest 100,000 tonne. Grades are rounded to the nearest decimal place for Ag, Zn, & Pb and the nearest 2 decimal places for Cu

- Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade, and contained metal.

- Tonnage and grade are in metric units; contained Zn, Cu, & Pb are in imperial pounds.

- Tonnages and grades are as reported directly from block model; with mined out areas removed.

- The effective date of the estimates is October 30, 2018.

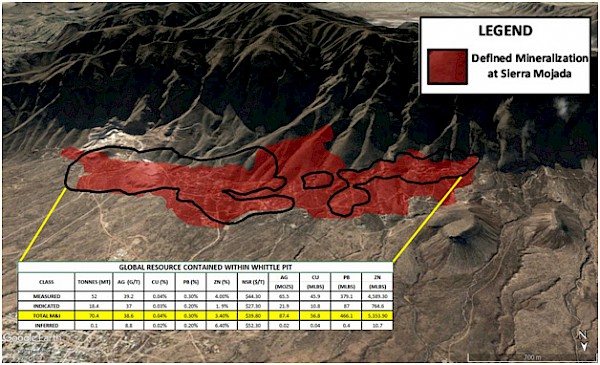

Figure 1. Image showing the Global Resource defined at Sierra Mojada. The Global resource reported

represents the mineralization (red) which fall within the optimized Whittle Pit shown by the black outline.

The High Grade Zinc and Silver Zones: The Global Resource encompasses two high grade zones of oxide mineralization; to better reflect high grade silver and zinc zones which form separate coherent bodies within the larger global resource we have broken out the zinc and silver mineralization using zinc and silver cutoff grades. The tables are shown below:

Table 2. “High Grade Zinc Zone” Pit-constrained Mineral Resource Estimate by Zinc Cut-Off

| Category | Zn Cut-off (%) | Tonnes (Mt) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | Ag (Mozs) |

Cu (Mlbs) |

Pb (MLbs) |

Zn (Mlbs) |

|---|---|---|---|---|---|---|---|---|---|---|

| MEASURED | 4 | 17.1 | 26.9 | 0.02% | 0.4% | 9.5% | 14.8 | 8.6 | 162.3 | 3,578.5 |

| 6 | 11.9 | 22.3 | 0.02% | 0.4% | 11.5% | 8.5 | 4.7 | 106.4 | 3,019.7 | |

| 8 | 8.6 | 19.3 | 0.02% | 0.4% | 13.3% | 5.3 | 2.9 | 69.9 | 2,505.1 | |

| 10 | 6.2 | 15.8 | 0.02% | 0.3% | 15.0% | 3.1 | 2.1 | 43.6 | 2,030.0 | |

| 11 | 5.1 | 14.5 | 0.02% | 0.3% | 15.8% | 2.4 | 1.7 | 34.0 | 1,794.8 | |

| 12 | 4.3 | 13.8 | 0.02% | 0.3% | 16.7% | 1.9 | 1.4 | 27.6 | 1,586.5 | |

| 13 | 3.6 | 12.9 | 0.02% | 0.3% | 17.5% | 1.5 | 1.2 | 21.2 | 1,381.2 | |

| 14 | 2.9 | 11.7 | 0.02% | 0.2% | 18.5% | 1.1 | 1.0 | 15.3 | 1,170.8 | |

| INDICATED | 4 | 2.5 | 22.2 | 0.03% | 0.3% | 7.7% | 1.8 | 1.5 | 17.6 | 417.0 |

| 6 | 1.6 | 20.4 | 0.03% | 0.3% | 9.2% | 1.0 | 0.9 | 11.1 | 317.0 | |

| 8 | 0.8 | 18.7 | 0.02% | 0.3% | 11.4% | 0.5 | 0.3 | 5.8 | 200.8 | |

| 10 | 0.4 | 19.2 | 0.02% | 0.3% | 13.7% | 0.2 | 0.2 | 2.9 | 124.4 | |

| 11 | 0.3 | 19.5 | 0.02% | 0.3% | 15.0% | 0.2 | 0.1 | 2.0 | 98.1 | |

| 12 | 0.2 | 19.6 | 0.02% | 0.3% | 15.9% | 0.2 | 0.1 | 1.6 | 83.1 | |

| 13 | 0.2 | 19.8 | 0.02% | 0.3% | 16.4% | 0.1 | 0.1 | 1.3 | 74.3 | |

| 14 | 0.2 | 21.9 | 0.02% | 0.3% | 16.9% | 0.1 | 0.1 | 1.1 | 65.3 | |

| TOTAL M&I | 6 | 13.5 | 22.0 | 0.02% | 0.4% | 11.2% | 9.6 | 5.6 | 117.5 | 3,336.6 |

| INFERRED | 4 | 0.05 | 5.9 | 0.01% | 0.2% | 8.5% | 0.01 | 0.01 | 0.2 | 9.97 |

| 6 | 0.04 | 6.5 | 0.01% | 0.2% | 9.6% | 0.01 | 0.01 | 0.2 | 8.60 | |

| 8 | 0.03 | 5.7 | 0.01% | 0.2% | 11.0% | 0.00 | 0.01 | 0.1 | 6.34 |

Table 3. Table 1-3. “High Grade Silver Zone” Pit-constrained Mineral Resource Estimate by Silver Cut-Off

| Category | Ag Cut-off (%) | Tonnes (Mt) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | Ag (Mozs) |

Cu (Mlbs) |

Pb (MLbs) |

Zn (Mlbs) |

|---|---|---|---|---|---|---|---|---|---|---|

| MEASURED | 25 | 21.0 | 83.6 | 0.08% | 0.5% | 2.6% | 56.5 | 37.4 | 245.8 | 1,222.25 |

| 35 | 15.9 | 101.2 | 0.10% | 0.6% | 2.5% | 51.6 | 34.4 | 201.6 | 869.2 | |

| 45 | 12.5 | 117.7 | 0.11% | 0.6% | 2.5% | 47.3 | 31.7 | 168.3 | 679.2 | |

| 50 | 11.2 | 126.6 | 0.12% | 0.6% | 2.5% | 45.3 | 30.3 | 155.0 | 611.2 | |

| 55 | 10.1 | 134.2 | 0.13% | 0.6% | 2.5% | 43.4 | 29.1 | 141.5 | 548.4 | |

| 60 | 9.1 | 142.3 | 0.14% | 0.6% | 2.5% | 41.7 | 28.0 | 129.8 | 493.2 | |

| 65 | 8.3 | 149.7 | 0.15% | 0.7% | 2.5% | 40.1 | 26.9 | 120.0 | 452.3 | |

| 70 | 7.5 | 158.4 | 0.15% | 0.7% | 2.5% | 38.4 | 25.6 | 110.6 | 409.9 | |

| 75 | 6.9 | 166.5 | 0.16% | 0.7% | 2.4% | 36.9 | 24.6 | 101.7 | 370.9 | |

| INDICATED | 25 | 10.4 | 54.9 | 0.03% | 0.2% | 1.3% | 18.4 | 7.9 | 53.2 | 288.1 |

| 35 | 7.3 | 65.4 | 0.04% | 0.2% | 1.3% | 15.4 | 6.6 | 40.0 | 208.2 | |

| 45 | 5.0 | 77.6 | 0.05% | 0.3% | 1.3% | 12.4 | 5.2 | 27.4 | 142.4 | |

| 50 | 4.1 | 84.0 | 0.05% | 0.3% | 1.3% | 11.1 | 4.4 | 23.2 | 119.5 | |

| 55 | 3.4 | 90.7 | 0.05% | 0.3% | 1.3% | 9.9 | 3.6 | 19.8 | 98.1 | |

| 60 | 2.9 | 96.8 | 0.05% | 0.3% | 1.3% | 8.9 | 2.9 | 17.0 | 83.0 | |

| 65 | 2.4 | 102.9 | 0.05% | 0.3% | 1.3% | 8.0 | 2.5 | 14.0 | 68.8 | |

| 70 | 2.0 | 109.5 | 0.05% | 0.3% | 1.3% | 7.2 | 2.2 | 11.8 | 56.6 | |

| 75 | 1.8 | 115.7 | 0.05% | 0.3% | 1.3% | 6.5 | 1.8 | 10.0 | 49.8 | |

| TOTAL M&I | 50 | 15.2 | 114.9 | 0.10% | 0.5% | 2.2% | 56.3 | 34.7 | 178.2 | 730.7 |

| INFERRED | 25 | 0.01 | 28.8 | 0.07% | 0.3% | 1.6% | 0.01 | 0.02 | 0.06 | 0.35 |

| 35 | 0.00 | 0.0 | 0.00% | 0.0% | 0.0% | 0.00 | 0.00 | 0.00 | 0.00 | |

| 45 | 0.00 | 0.0 | 0.00% | 0.0% | 0.0% | 0.00 | 0.00 | 0.00 | 0.00 |

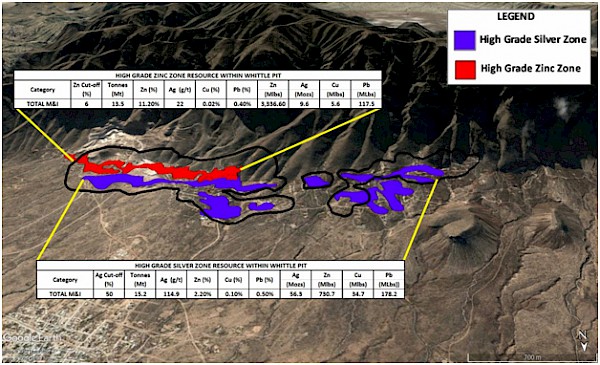

Figure 2. Image showing the locations of the High Grade Silver Zone at a 50g/t Ag cutoff grade and Zinc

Zone at a 6% Zn cutoff grade. The resource reported are the areas of these zones which fall within the

optimized Whittle Pit shown by the black outline.

In order to establish the economics in an open pit context, the reported resources fall within a Whittle Optimized pit shell that uses a silver price of US$15/oz and a zinc price of US$1.20/lb with a recovery of silver estimated at 75% and zinc at 41%. Pit walls are set at 55 degrees overall, mining costs were assumed to be US$1.50/tonne, and silver and zinc processing costs were assumed to be US$12.00/tonne, which results in a total NSR cutoff for the resource of $13.50/tonne.

Mineral resources were estimated by ordinary Kriging using GEMSTM modeling software in multiple passes using 10 meter X 10 meter X 10 meter blocks as the SMU size. Blocks have been classified as measured, indicated or inferred mineral resources.

The mineral resource has been estimated by Matthew Dumala, P.Eng., of Archer, Cathro & Associates (1981) Limited and Timothy Barry, MAusIMM(CP)., of Silver Bull. Both Mr. Dumala and Mr. Barry are Qualified Persons as defined by National Instrument 43-101 and are responsible for the Technical Report filed onto the SEDAR website “Technical Report on the Resources of the Silver-Zinc Sierra Mojada Project Coahuila, Mexico”.

Changes in the resource: This new NI43-101 resource update supersedes the NI43-101 Resource completed by Silver Bull in June 2015. With significant movement in the metal prices of both silver and zinc since 2015, management thought it prudent to recalibrate the mineral resource at Sierra Mojada to the current price environment. This has resulted in an increase from US$1.00/lb to $US1.20/lb for Zinc and a decrease from US$18/oz to US$15/oz for Silver for this resource update. This has resulted in a significant increase in the zinc resource and a slight decrease in the silver resource at Sierra Mojada. A summary table between the two resources is shown below.

Table 4. Mineral Resource Comparison

| Estimate | June 2015 Mineral Resource Estimate | ||||

|---|---|---|---|---|---|

| Mt | Ag g/t | Zn% | Ag Moz | Zn MLb | |

| June 2015 Mineral Resource Estimate | |||||

| Measured | 35.3 | 48.5 | 4.4% | 55.0 | 3,434.9 |

| Indicated | 21.5 | 51.6 | 1.8% | 35.8 | 846.8 |

| Total M&I | 56.8 | 49.7 | 3.4% | 90.8 | 4,281.7 |

| Inferred | 0.2 | 44.7 | 1.3% | 0.3 | 6.2 |

| October 2018 Mineral Resource Estimate | |||||

| Measured | 52.0 | 39.2 | 4.0% | 65.5 | 4,589.3 |

| Indicated | 18.4 | 37.0 | 1.9% | 21.9 | 764.6 |

| Total M&I | 70.4 | 38.6 | 3.4% | 87.4 | 5,353.9 |

| Inferred | 0.1 | 8.8 | 6.4% | 0.02 | 10.7 |

About Silver Bull: Silver Bull is a well-financed mineral exploration company whose shares are listed on the Toronto Stock Exchange and trade on the OTCQB in the United States, and is based out of Vancouver, Canada. The Sierra Mojada Project is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc.

In June 2018 Silver Bull signed an agreement with a wholly owned subsidiary of South32 Limited (ASX/JSE/LSE: S32) ("South32") whereby Silver Bull has granted South32 an option to form a 70/30 joint venture with respect to the Sierra Mojada Project. To maintain the option in good standing, South32 must contribute minimum exploration funding of US$10 million ("Initial Funding") during a 4 year option period with minimum aggregate exploration funding of US$3 million, US$6 million and US$8 million to be made by the end of years 1, 2 and 3 of the option period respectively. South32 may exercise its option to subscribe for 70% of the shares of Minera Metalin S.A. De C.V. ("Metalin"), the wholly owned subsidiary of Silver Bull which holds the claims in respect of the Sierra Mojada Project, by contributing US$100 million to Metalin for Project funding, less the amount of the Initial Funding contributed by South32 during the option period.

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800 info@silverbullresources.com

Cautionary Note to U.S. Investors concerning estimates of Measured, Indicated, and Inferred Resources:This press release uses the terms "measured resources", "indicated resources", and "inferred resources" which are defined in, and required to be disclosed by, NI 43-101. We advise U.S. investors that these terms are not recognized by the United States Securities and Exchange Commission (the "SEC"). The estimation of measured, indicated and inferred resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that measured and indicated mineral resources will be converted into reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. U.S. investors are cautioned not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated mineral resources. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies.

Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations, however the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, the information contained in this press release may not be comparable to similar information made public by U.S. companies that are not subject NI 43-101.

Cautionary note regarding forward looking statements: This news release contains forward-looking statements regarding future events and Silver Bull's future results that are subject to the safe harbors created under the U.S. Private Securities Litigation Reform Act of 1995, the Securities Act of 1933, as amended (the "Securities Act"), and the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and applicable Canadian securities laws. Forward-looking statements include, among others, statements regarding mineral resource estimates and ability of resource to provide excellent leverage to both zinc and silver prices and potential to be scaled in size depending on metal prices. These statements are based on current expectations, estimates, forecasts, and projections about Silver Bull's exploration projects, the industry in which Silver Bull operates and the beliefs and assumptions of Silver Bull's management. Words such as "expects," "anticipates," "targets," "goals," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "may," variations of such words, and similar expressions and references to future periods, are intended to identify such forward-looking statements. Forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control, including such factors as the results of exploration activities and whether the results continue to support continued exploration activities, unexpected variations in ore grade, types and metallurgy, volatility and level of commodity prices, the availability of sufficient future financing, and other matters discussed under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended October 31, 2017 and our Quarterly Report on Form 10-Q for the interim period ended April 30, 2018, as amended, and our other periodic and current reports filed with the SEC and available on www.sec.gov and with the Canadian securities commissions available on www.sedar.com. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements. Any forward-looking statement made by us in this release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.